While the month of January takes its name from “Janus” (the Roman god of thresholds, of beginnings and endings, derived from the Latin word “ianua,” meaning “door” — the Latin language uses an “i” where we use a “j”), the month of February, the last month of the year in the Roman calendar, comes from “Februum” (meaning the god of “purification,” intended to cleanse, purify, and close out the calendar in order to make way for all the fertility and creativity of a beginning new year).

And perhaps February is aptly and appropriately named, as financial markets reflect upon, digest, and react to the public health, economic, political, geopolitical, and financial developments of 2020 and the news-filled beginning days of 2021. The four weeks of a fairly choppy January featured all-time records at various points in time for the Dow Jones Industrial Average, the S&P 500, the NASDAQ Composite, and the Russell 2000 index of small- and mid-cap companies, against a backdrop of: (i) on January 6th, social insurrection in the nation’s capital; (ii) on January 13th, the 232-197 vote by the House of Representatives to impeach the 45th president; (iii) on January 20th, the inauguration of America’s 46th president; and (iv) on January 27th, a sharp -3.5% selloff in the S&P 500 (its biggest one-day decline since October 28th), sparked in part by an online trading app- and social media-driven market frenzy pitting significant numbers of largely amateur investors (in somewhat of a loosely coordinated fashion, buying certain shares and options in expectations of rising prices) against a much more limited population of hedge funds which had established short positions in these same companies (in expectations of declining prices).

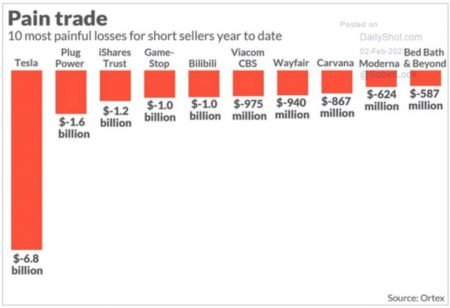

On a year-to-date basis through early February, the chart above sets forth a representative list of capital losses realized on select shares that were borrowed, sold short, and then had to be covered at higher prices.

As the VIX volatility index closed out January at a rather elevated 33.09 (up +45% versus year-end 2020), on a price basis over the month, the S&P 500 declined -1.1%, the KBW index of the 24 largest U.S. banks lost -0.1%, the 20-stock Dow Jones Transportation Index retreated -3.3%, physical gold fell -2.4%, and the NYSE Arca Gold Miners index contracted -4.2%. (Source: The Wall Street Journal). By contrast, the Russell 2000 index of small- and mid-cap stocks gained +5.0%, the MSCI Emerging Market equities index rose +3.2%, West Texas Intermediate crude oil prices increased +7.6%, the Alerian Master Limited Partners Infrastructure index advanced +5.5%, and the DXY U.S. dollar appreciated +0.6% against its six-member component index. (Source: The Wall Street Journal)

With U.S. Treasury short-term interest rates declining somewhat and intermediate- and longer-term interest rates exhibiting a meaningful rise, the Treasury yield curve steepened in January. On the last trading day of the month in the fixed income realm, 2-year U.S. Treasury bonds yielded 0.11% (down two basis points from 0.13% on December 31st), 10-year U.S. Treasury bonds yielded 1.11% (up 18 basis points from 0.93% on December 31st), and 30-year U.S. Treasury bonds yielded 1.87% (up 22 basis points from 1.65% on December 31st). (Source: The Wall Street Journal)

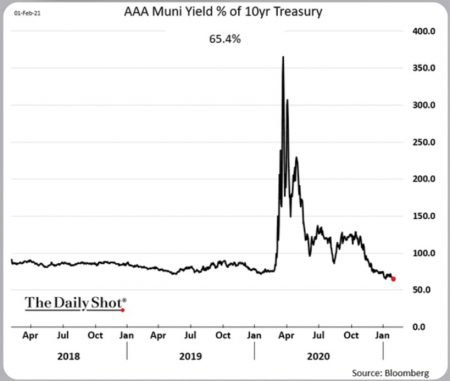

Reflecting their relative richness (high valuations relative to U.S. Treasury securities), as well as individual investors’ putative desire for tax-exempt yield in an environment of higher personal taxes at some point under the new administration, as shown in the following chart tax-exempt yields have reached multiyear lows (65.4%) as a percentage of U.S. Treasury yields:

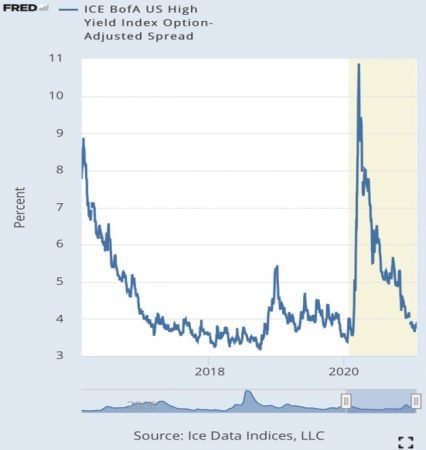

High-yield bonds also trade near multiyear low spread levels versus U.S. Treasury securities, indicative of the rather elevated valuations placed on such securities by investors seeking to generate income from the bond allocations of their portfolios:

THE INVESTMENT OUTLOOK

The year we have just lived through has presented a not inconsiderable number of challenging developments, as investors have had to rethink many deeply-held assumptions about government policies, societal dynamics, work patterns, family relationships, and economic security. Our ways of living, learning, being entertained, and working have undergone significant fundamental change in the United States and in many other parts of the world. Zoom Video Communications, Google’s Meet, Microsoft’s Teams, and other collaboration platforms have stepped into the void created by the cancelation of in-person meetings. Increasing numbers of citizens have hastened the process of relocating from high-tax parts of the country to more tax-efficient areas that may happen also to lower the cost of living and enhance their quality of life.

The changes effected last year have been profound and widespread and many have continued into 2021. Several segments of the economy — Including the hospitality, gaming, lodging, and travel sectors, among others — are likely to require significant amounts of time to return to pre-crisis conditions. With the pandemic having unsettled in-person schooling, exacerbated incomes and societal inequality, and spurred change in social justice, climate awareness, and innovation, disruptive forces are likely to persist in areas ranging from traditional business models to fossil fuels to all levels of education. The shift toward Asia — in China and other countries — in the global economy has accelerated in the past 12 months. With its consumer sector projected to grow from 45% of the Chinese economy in 2020 to 60% in 2025 (Source: The Wall Street Journal), China has also stepped up its investments in semiconductors, artificial intelligence, 5G wireless, and other core technologies, and these emphases appear likely to continue.

With some degree of caution, we remain essentially constructive on the U.S. equity market outlook, owing to:

i. Continued levels of meaningful monetary policy support, in the form of ultra-low short-term interest rates and money printing (“Quantitative Easing”) by the Federal Reserve to purchase $120 billion per month of U.S. Treasury and mortgage-backed securities;

ii. Substantial fiscal stimulus by the U.S. government, likely in the $1.0–$1.5 trillion range;

iii. An accelerated pace of coronavirus vaccines rollout;

iv. High corporate, federal government, and household cash balances (even before the recent Treasury distribution of $600 checks, not to mention the Administration’s proposed new round of checks, personal savings are $1.5 trillion higher than pre-pandemic levels);

v. Healthy equity sector and style rotation, including growth to value, large-cap to small- and mid-cap, defensives to cyclicals, and domestic to international;

vi. An improving economic outlook — based on assumptions that the economy can decouple from the coronavirus through the vaccines program, economists expect considerable pent-up demand for household consumption in the latter half of the year, with U.S. 2021 GDP likely to meet or even exceed the +5.1% forecast of the International Monetary Fund (raised from +3.1% on January 26th); and

vii. Analysts’ expectations of robust year-over-year S&P 500 revenue and corporate profits gains, with projected growth rates as reported by Factset on January 29th as follows — for 1Q21, revenue growth of +4.8% and earnings growth of +19.6%, for 2Q21, revenue growth of +15.1% and earnings growth of +48.7%, for 3Q21, revenue growth of +9.0% and earnings growth of +16.0%, for 4Q21, revenue growth of +7.0% and earnings growth of +17.2%, and for full year 2021, revenue growth of +8.7% and earnings growth of +23.6%.

At the same time, given widespread investor bullishness, elevated valuations of stocks and (especially) bonds, and numerous instances of broadening speculative activity — in call options buying, cryptocurrency infatuation, heightened household equity trading participation, and IPO volume (fully half of which in 2020 was for “blank-check” companies, also known as Special Purpose Acquisition Companies, or “SPACs”), we feel it is prudent to be prepared for one or more possibly meaningful market corrections during the course of this year.

For the rest of 2021, investors need to consider what can go awry at the same time as they are contemplating optimistic scenarios. Included among the potential factors that could derail advancing equity prices are:

i. Faster-than-expected increases and/or higher-than-expected increases in interest rates;

ii. Pandemic setbacks (including coronavirus mutations and/or decisions not to be vaccinated by a sufficiently large portion of the population leading to renewed economic lockdowns);

iii. Legislative passage of more burdensome-than-anticipated tax increases;

iv. Serious deterioration in U.S.-China relations;

v. Disappointing results on the earnings and/or regulatory fronts, especially for highly-valued bellwether technology and social media companies; and

vi. Episodes of serious turbulence in the global currency and/or energy markets.

Formidable levels of euphoria exist in several areas of the financial realm, and assessments of an economic recovery in 2021 may already be somewhat reflected in the pricing of many stocks and industry sectors.

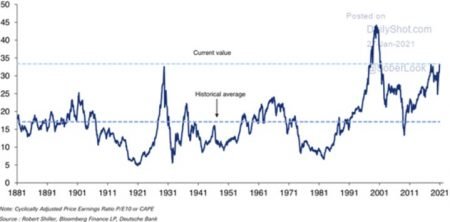

The Cyclically-Adjusted Price Earnings ratio (also known as the CAPE ratio, or the Shiller ratio, named after its creator, 2013 Nobel Economics Laureate Yale Professor Robert Shiller) is calculated by dividing prices not by one year’s trailing or forward earnings, but by the average of the past 10 years’ inflation-adjusted earnings. The chart below shows that the current reading for the CAPE ratio, at 34.88, is 108% above the CAPE ratio’s long-term median reading of 16.78, and with one exception (in December 1999, when it reached 44.19) the highest it has been in the 140-year history of this data series.

Several other valuation measures — including forward and trailing price-earnings ratios, and total equity market capitalization-to-GDP ratios — are quite extended and may not offer much support in the face of unpleasant surprises on the U.S.-China relationship, setbacks in economic momentum, seriously dysfunctional political discord, and especially, inflation (due to its influence on interest rates).

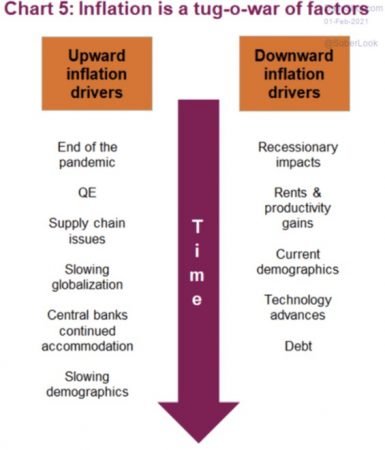

The chart below shows many of the key drivers that could put upward or downward pressure on inflation.

For now, based on considerable unused capacity in the manufacturing sector and in the labor force, we expect only modest increases in inflation over the full year — even as some of the numbers that will be reported over the April-July 2021 time frame could possibly show potentially worrisome rates of gain versus the distressed conditions of a year earlier. At its December 15th-16th meeting, the Federal Reserve Open Market Committee expressed expectations of PCE (Personal Consumption Expenditures) inflation reaching +1.8% in 2021, slightly above its previous estimate of +1.7%.

Multiples of Enterprise Value-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) are in the high 90th percentiles of their historical values. It is important to keep in mind that lofty equity valuations for 2021 and 2022 remain highly dependent on interest rates remaining low — by no means an inevitable outcome, given: (i) nascent inflationary trends (as potentially stoked by the drivers in the abovementioned chart); (ii) large projected issuance of government debt; and (iii) waning foreign demand for U.S. Treasury bonds.

Successful investment outcomes in 2021 may very well be achieved more from (i) generating what is referred to as “idiosyncratic alpha” (that is, by selecting specific asset classes, securities, sectors, and managers) rather than relying on (ii) market beta (primarily aiming to copy the performance of the broad stock and bond market indexes). Concurrently, we expect a broadening out of the main drivers of the indexes, in contrast to how in 2020 only three stocks, Apple (+80%), Amazon (+76%), and Microsoft (+41%) accounted for more than half of the S&P 500‘s +16.3% total price gain. And without the top 24 largest-cap companies, heavily represented by technology, social media, and digital services, the S&P 500 would have actually experienced a negative price return in 2020.

RECENT MARKET RUCTIONS

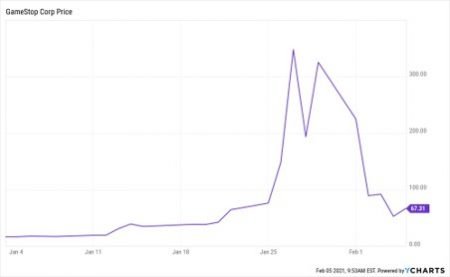

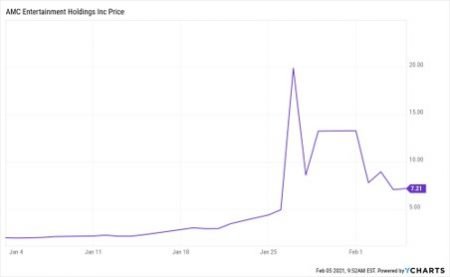

On Tuesday, February 2nd, U.S. Treasury Secretary Janet Louise Yellen called a meeting — inviting senior officials from the Federal Reserve Board, the Federal Reserve Bank of New York, the Commodity Futures Trading Commission, and the Securities and Exchange Commission — to examine, among other topics: the late January and early February upsurge in stock market volatility; the content and uses of online investor forums such as the Wall Street Bets subreddit; the high retail investor-driven trading volume in stocks and options; the massive intra- and inter-day price swings and broker-imposed trading restrictions in the shares of GameStop, AMC Entertainment, Express, Blackberry, Bed Bath & Beyond, Koss, and other companies and assets, including silver and Special Purpose Acquisition Companies (“SPACs”) . Other Authorities investigating these issues include the U.S. House of Representatives Financial Services Committee, which has scheduled hearings beginning Thursday, February 18th, and the U.S. Senate, which has also called for hearings.

Recent price histories for the shares of GameStop and AMC Entertainment are shown in the charts below.

Shares of GameStop, AMC Entertainment, and a number of other companies had been targeted by a motley, passionate, somewhat aggrieved, rapidly expanding online community of (often neophyte) investors seeking to drive their stock prices higher in efforts: (i) to generate short-term trading profits; and/or (ii) to penalize hedge funds and other investors who had “sold the shares short” (meaning the hedge funds and others had borrowed the shares and sold them, hoping for a price drop that would allow them to replace the shares at a lower price and thereby earn a profit).

In our opinion, the regulators’ analytical oversight and analysis of recent weeks’ unusually labile price behavior stems not only from whipsawing prices in a handful of stocks, but also from broader concerns over:

i. Appropriate regulation and enforcement, strengthening investor protections against price manipulation and other forms of market-based malfeasance;

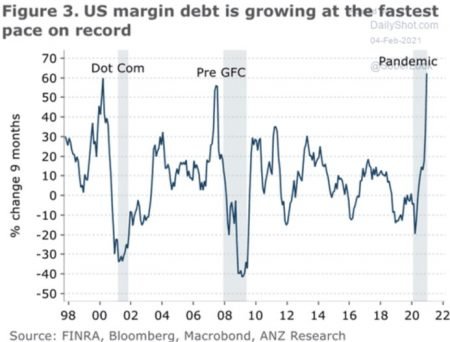

ii. Fortifying minimum levels of investor education and risk awareness, especially in the derivatives markets and in the use of leverage (please refer to the following chart for a depiction of the current high levels of stock market leverage) — which, it can be seen, tend to accelerate downward equity market price movements during meaningful stock market selloffs;

iii. Preserving the functioning of fair and orderly securities markets;

iv. Adapting risk monitoring and other surveillance mechanisms to keep pace with changes in communications methods, social networking and online communities’ mores and memes, artificial intelligence, high frequency trading, and algorithmic investment protocols;

v. Educating the public about the components, costs, risks, and benefits of trading restrictions, the activity of bots, interest on customers’ credit balances, margin lending and margin calls, trading spreads earned by market makers, short interest levels, commission-free trading activity, and payment-for-order-flow;

vi. Constructing adequate safeguards to slow, or in some cases prevent, contagion (where significant stresses in one part of the securities markets lead to equally if not more severe stresses in other parts of the securities markets);

vii. Ensuring the robust financial strength and the problem-free, reliable operation of the Depository Trust and Clearing Corporation, the National Securities Clearing Corporation, and other settlement and clearing systems in American capital markets; and

viii. Establishing explicit — even if voluntary — standards and guidelines for posts on social media, similar to those governing the publication of written investment research reports, discouraging overly flamboyant, promissory, or inflammatory statements.

Armed with some degree of historical perspective and knowledge that all manias usually come to an unattractive end, our counsel for some time has been and continues to be deeply grounded in the following principles:

i. An elemental component of long-term investment success in liquid securities markets involves (a) keeping in mind that a fundamental motivation for investing in equities is to gain exposure to long-term value creation by business, and (b) gaining and maintaining exposure to high-quality assets that allow the investor to generate compound returns over time;

ii. It is important to avoid getting caught up in crowd-driven manias in the financial markets, and among the ways to keep distance and perspective is to seek the input and advice of people with investment experience and sound judgment; and

iii. Investors need to devote time and thought to formulate a sound investment plan, and keep to it, only giving consideration to making meaningful revisions (a) when warranted by changes in personal circumstances and/or the economic and financial environment; and/or (b) when asset prices depart widely (on the upside or downside) from fundamental values.

PORTFOLIO POSITIONING

1. Strategies and Tactics: In the current post-election environment and throughout its expected evolution in the early years of the new presidential and congressional term, we continue to maintain that careful thought, planning, and attention needs to be devoted to the investor’s most appropriate forms and vehicles for implementing the fundamental elements of Asset Allocation and Investment Strategy:

i. Diversification: which means having sustainably low- and negatively-correlated investment exposures that truly counterbalance price movements in other assets, particularly during times of great financial stress and/or market volatility;

ii. Rebalancing: which encompasses using concepts of reversion to the mean to trim exposures to assets that have grown to represent too large a portion of the overall portfolio, while at the same time, adding exposure to high-quality assets that have fallen out of investor favor and suffered significant, though likely not permanent, price declines;

iii. Risk Management: which involves recognizing when markets become consumed by momentum plays and information overload — a situation that pertains to numerous companies in the technology space – and understanding the degree of liquidity, the true pricing realism, and the various roles of short-term liquid securities, real assets, financial assets, and alternative assets in decade-long (or longer) regimes of inflation, stagflation, deflation, monetary disruptions, and currency resets;

iv. Reinvestment: which encompasses knowing when to emphasize and trade off income versus capital growth, all the while keeping in mind the critical importance of discipline, patience, and longevity in capturing and compounding dividend, coupon, and other income flows; and

v. Asset Protection and Husbandry: which encompass considerations of taxation at the state, local, federal, and possibly international level; estate planning; relevant insurance design and structuring; cybersecurity shielding; portfolio monitoring and reporting; administrative costs; forms and means of access; and custody.

2. Intermediate-Term Themes to Consider: We continue to allocate to a considered and considerable exposure to equities, with judicious shifts between styles, sectors, geographies, and — where appropriate from a cost, timing, liquidity, and size standpoint — public versus private markets. Expressed below are a number of themes that we believe should be taken into consideration over the next few years in selecting asset categories, asset classes, sectors, companies, and security types:

i. Paying Attention to the Value of Money: Taking advantage of (rather than being taken advantage of by) the likelihood of money printing, internal and external currency debasement, government debt monetization, and the ‘Modern Monetary Theory’ likely to continue being pursued by the Authorities — within shifting money and credit cycles — to service America’s massive explicit government and corporate indebtedness and the enormous implicit obligations of pension and healthcare promises;

ii. Concentrating on “All-Weather” Sectors and Companies: Seeking investments with balance and flexibility, that are able to thrive regardless of a now apparently “blue wave” unified congress, evolving social priorities and values, wealth distribution initiatives, public health conditions, and political trends;

iii. Distinguishing Between Temporary and Permanent Change: Focusing on the commercial and financial implications of new social and political power structures, alliances, and geopolitical relationships; new energy sources and resources; new trade patterns; new on- and offshoring channels; “WFH” and “WFA” (Work From Home and Work From Anywhere) employment modalities; and new business models, pathways, digitalizations, and forms of person-to-person and business-to-business work, leisure, learning, and wellness;

iv. Taking Advantage of Demographic Tailwinds: Through U.S. and select non-U.S. companies, gaining exposure to and meeting the rising needs, aspirations, and spending power of the rapidly expanding global middle class, especially in Asia;

v. Comprehending and Verifying Past Success: Emphasizing companies and sectors that have demonstrated successful track records and past experience in: capital allocation; balance sheet strength; risk management; sustainably defendable business models; and the ability to generate and sustain high multiyear returns on equity (derived from revenue growth and favorable margin preservation, rather than through excessive leverage) meaningfully above the companies’ and sectors’ weighted average cost of capital; and

vi. Identifying Innovative and Disruptive Technology Hegemons: Focusing on technology enablers, disrupters, and dominators in biotechnology, public health, artificial intelligence, data analytics, machine learning, 5G cellular network technology, the Internet of Things, robotics, quantum computing, battery inventions, alternative energy, electric vehicles, and cybersecurity, while paying heed to the environmental, social, and governance (ESG) characteristics of companies in these fields.

3. Keeping Things in Perspective: Many of the overarching themes and conditions that influence our intermediate- and long-term asset allocation and investment strategy emphasize the need to recognize that the concepts and implementation methods intended to achieve safety, balance, diversification, and liquidity are likely to face evolving taxation regimes, social priorities, geopolitical power relationships, price level changes, demographic trends, indebtedness levels, technological pervasiveness, and not least, the definition, role, degree of physicality, embodiment, and value of money itself.

4. Flexibility versus Conviction in Formulating Investment Thinking: In seeking to determine when to adhere to, and when to lean against, prevailing consensus views (sometimes pejoratively referred to as “groupthink”), it is important to critically question the soundness and durability of the reasoning and assumptions underlying a given investment framework and positioning at any point in time. While it may not make sense to hold out-of-consensus views just for the sake of doing so — often expressed as “don’t fight the tape,” — at other times — especially at major cyclical or secular turning points (at a major asset top, when reality is finally found to fall short of overly optimistic expectations, or a major asset bottom, when reality is shown to be worth considerably more than the prevailing overly pessimistic expectations), the rewards of implementing a contrarian stance can be extremely meaningful.

Some observations on the environment and conditions expected in the quarters and year ahead are set forth in the sections below.

5. Enhancing and Preserving: While we confess to an even greater than last year’s feeling of unease over the spreading investor exuberance and the growing popularity of stocks and sectors considered to benefit from economic recovery as vaccines are rolled out to contain and even halt the pandemic — our short-term inclination at this juncture is to take note of the Federal Reserve’s ongoing support of financial asset prices while taking advantage of such strength to continue upgrading portfolio holdings — offloading lower-quality, higher-risk assets and with timing and price discipline, adding to attractively-priced, higher-quality assets on equity market pullbacks.

6. Equity Emphases and De-emphases: Particularly in the current conditions of very low U.S. Treasury interest rates, and given the likely focus areas of government spending initiatives, to us it appears likely that cash-generating, financially-stable companies with robust growth prospects, which are able to operate and thrive in the digital sphere as they continue to enhance their business models, deserve to retain a valuation premium. Within equities one may consider: (i) continuing to gradually shift some emphasis from Growth sectors, companies, and managers towards the incremental inclusion of select Value sectors, companies, and managers; (ii) modestly adding small- and mid-cap companies (or investment managers specializing in and with good track records in this space) to our primary yet lessening emphasis on large-capitalization enterprises; and (iii) for the time being, while we continue to prefer a tactical overweighting to U.S. domestic equities but beginning to build higher allocations to emerging market equities and our underweight position in the international developed markets.

7. Focus on Strength and Quality: Our long-term equity portfolio weightings continue to emphasize asset managers, sectors, and specific companies that can benefit from the major sustained trends of the 2020 decade, including: (i) incremental growth in a wide range of economic circumstances; (ii) a focus on economic repair, digitalization, e-commerce, personal wellness, safety, domesticity, home improvement, infrastructure spending, and where possible, the release of pent-up consumer demand; and (iii) advantageous capture of benefits from onshoring, supply chain redesign, and deglobalization as important drivers of capital spending and disruptive innovation. At the company level in equities, we emphasize identifying and building long-term exposure to firms possessing fortress-like, cash-rich balance sheets, limited debt, positive free cash flow generation, dividend strength, and competitive business models that over a long-time frame can generate high returns on equity (as mentioned above in “Comprehending and Verifying Past Success,” through revenue growth and enduring profit margins, rather than through excessive levels of leverage).

8. Balancing Growth and Value Sectors: Through Wednesday, February 5th, the iShares Russell 1000 Growth ETF (symbol IWF, and including companies in sectors such as technology, healthcare, and communication services) had (according to The Wall Street Journal) returned +4.3%, while the iShares Russell 1000 Value ETF (symbol IWD, and including companies in sectors such as financial, real estate, energy, utility, and industrial companies) had (according to The Wall Street Journal) returned +3.8%; this 0.5 percentage point Growth minus Value returns differential is much narrower than the 30-plus percentage point Growth minus Value differential in recent months and to us appears now to argue for continuing the process of prudent reallocation from selected Growth sectors, companies, and managers into selected Value sectors, companies, and managers. As this process continues, it is worth keeping in mind that true value investing represents identifying assets that are trading for less than they are actually worth, not assets that are merely inexpensive; many superficially inexpensive assets are inexpensive for a reason and can very well remain so or deteriorate further.

9. Fixed Income Securities: Bond prices remain at extremely elevated price levels, with ultralow yields across the maturity spectrum, having risen only modestly since year-end 2020 (with, according to Bloomberg in mid-December, an astounding total of $18 trillion in global negative yielding sovereign — and some corporate — debt outstanding). We affirm our predilection for issuers at the high-quality end of the rating spectrum, both in investment grade and in high-yield bonds, in taxable bonds, and in tax-exempt bonds (where we continue to see some pockets of value on a taxable equivalent basis). We see fixed income securities price risk due to our expectation of further increases in yield levels as 2021 progresses, and thus we prefer maturities and durations along the short-to-intermediate portion of the yield curve spectrum.

10. U.S. Dollar Outlook: After declining -7.4% In 2017, appreciating +4.3% in 2018, marginally slipping -0.2% in 2019, and declining -5.1% in 2020, the DXY U.S. dollar index measured versus a basket of six major currencies — the euro, Japanese yen, Swedish kroner, British pound, Canadian dollar, and Swiss franc — had as of the market close on February 5th, appreciated +1.2% year-to date in 2021. We believe the U.S. dollar may trace a gradual path of weakness as — due primarily to the Federal Reserve’s stated preference for lower yields in the United States for the next 12 months or even longer — the U.S. dollar’s income-generating advantage is likely for the time being to remain narrow or nonexistent versus other major currencies.

11. Alternative Investments and Real Assets: In alternative investments, we continue our multi-quarter focus that has for some time emphasized exposure to: upstream natural resources ETF/shares (particularly the miners with reserves in stable geographic locations, capital discipline, and cash flow growth); select investments in private credit and private real estate; and opportunistic private equity strategies/direct investments that are positioned to selectively derive meaningful value from the dislocations created by the coronavirus pandemic and the gradually increasing recovery that we expect in the year ahead as well as those which may provide a better use of risk budget relative to public markets.

DISCLOSURES

*Aaron Wealth Advisors LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). Aaron Wealth Advisors LLC only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.

*This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy or sell securities, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances or any particular investor or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors. The information contained in this presentation represents factual information, analysis, and/or opinions regarding various investments. Any opinions expressed in this material reflect Aaron Wealth’s views as of the date(s) indicated on the Presentation and are subject to change.

*Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), or product made reference to directly or indirectly, will be profitable or equal to past performance levels.

*This document contains forward looking statements, including observations about markets and industry and regulatory trends as of the original date of this document. Forward looking statements may be identified by, among other things, the use of words such as ”expects,” “anticipates,” “believes,” or “estimates,” or the negatives of these terms, and similar express results could differ materially from those in the forward looking statements as a result of factors beyond our control. Recipients of the information herein are cautioned not to place undue reliance on such statements. No party has an obligation to update any of the forward looking or other statements in this document.

*All investment strategies have the potential for profit or loss. The investment strategies illustrated in this document and listed above involve risk, including the risk of loss of principal.

*The firm is not engaged in the practice of law or accounting. Content should not be construed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation.

*This material is proprietary and may not be reproduced, transferred, modified or distributed in any form without prior written permission from Aaron Wealth Advisors. Aaron Wealth reserves the right, at any time and without notice, to amend, or cease publication of the information contained herein. Certain of the information contained herein has been obtained from third-party sources and has not been independently verified. It is made available on an “as is” basis without warranty. Any strategies or investment programs described in this presentation are provided for educational purposes only and are not necessarily indicative of securities offered for sale or private placement offerings available to any investor.